Debt-to-Equity D E Ratio: Calculation, Importance & Limitations

The debt to equity ratio is a financial, liquidity ratio that compares a company’s total debt to total equity. The debt to equity ratio shows the percentage of company financing that comes from creditors and investors. A higher debt to equity ratio indicates that more creditor financing (bank loans) is used than investor financing (shareholders). This looks at the total liabilities of a company in comparison to its total assets.

Degree of Financial Leverage

As you can see, company A has a high D/E ratio, which implies an aggressive and risky funding style. Company B is more financially stable but cannot reach the same levels of ROE (return on equity) as company A in the case of success. Therefore, comparing D/E ratios across different industries should be done with caution, as what is normal in one sector may not be in another.

What Is a Good Leverage Ratio?

Such an agreement prevents the borrower from taking on too much new debt, which could limit the original creditor’s ability to collect. As noted above, it’s also important to know which type of liabilities you’re concerned about — longer-term debt vs. short-term debt — so that you plug the right numbers into the formula. This ratio is useful in determining how many years of earnings before interest, taxes, depreciation, and amortization (EBITDA) would be required to pay back all the debt.

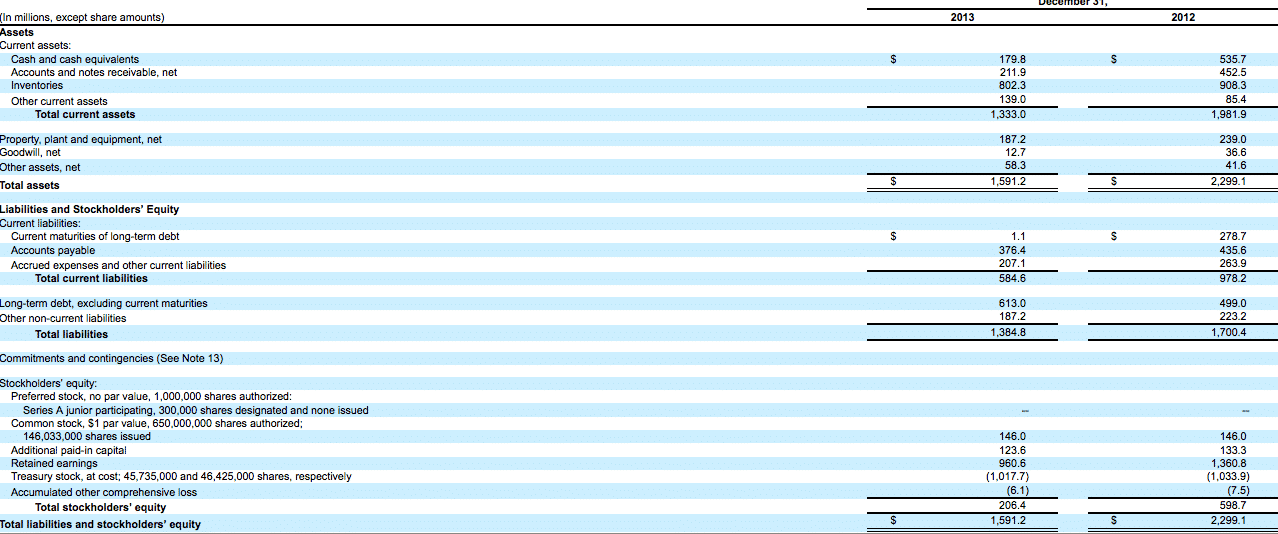

Formula and Calculation of the D/E Ratio

A good D/E ratio of one industry may be a bad ratio in another and vice versa. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

The debt-to-equity ratio (D/E) is one of many financial metrics that helps investors determine potential risks when looking to invest in certain stocks. In fact, debt can enable the company to grow and generate additional income. But if a company has grown increasingly reliant on debt or inordinately so for its industry, potential investors will want to investigate further. When using the D/E ratio, it is very important to consider the industry in which the company operates. Because different industries have different capital needs and growth rates, a D/E ratio value that’s common in one industry might be a red flag in another. Gearing ratios constitute a broad category of financial ratios, of which the D/E ratio is the best known.

- If it issues additional debt, it will further increase the level of risk in the company.

- Companies can improve their D/E ratio by using cash from their operations to pay their debts or sell non-essential assets to raise cash.

- In other words, the assets of the company are funded 2-to-1 by investors to creditors.

- Because debt is inherently risky, lenders and investors tend to favor businesses with lower D/E ratios.

- Such an agreement prevents the borrower from taking on too much new debt, which could limit the original creditor’s ability to collect.

- IFRS and US GAAP may have some differences in the way of accounting for certain liabilities and assets which could lead to difference in the debt-to-equity ratio calculation.

As an individual investor you may choose to take an active or passive approach to investing and building a nest egg. The approach investors choose may depend on their goals and personal preferences. Debt-to-equity ratio is just one piece of the puzzle when it comes to evaluating stocks. Whether the ratio is high or low is not the bottom line of whether one should invest in a company.

For example, in the quarter ending June 30, 2023, United Parcel Service’s long-term debt was $19.35 billion and its total stockholders’ equity was $20.0 billion. In 2023, following the collapse of several lenders, regulators proposed that banks with $100 billion or more in assets dramatically add to their capital cushions. These restrictions naturally limit the number of loans made because it is more difficult and more expensive for a bank to raise capital than it is to borrow funds. Higher capital requirements can reduce dividends or dilute share value if more shares are issued. Retained earnings, also known as retained surplus or accumulated earnings, are a component of shareholder equity and should be included in the denominator of the debt-to-equity ratio.

If a bank is deciding to give this company a loan, it will see this high D/E ratio and will only offer debt with a higher interest rate in order to be compensated for the risk. The interest payments will be higher 9 best accounting software for ecommerce companies best ecommerce software on this new round of debt and may get to the point where the business isn’t making enough profit to cover its interest payments. The debt-to-equity ratio is primarily used by companies to determine its riskiness.