What is notes receivable?

Content

- Using Notes Receivable to Generate Cash

- Balance Sheet Reporting and Disclosures: Assets-Accounts Receivable

- Financial Accounting

- Dishonored Notes Receivable Definition

- Present Value – Accounting Examples (for

- Example of Notes Receivable Accounting

- Step 4: Entry for the default of the loan

- Characteristics of Notes Receivable

(b)”Four months after date, I promise to pay…” When the maturity is expressed in months, the note matures on the same date in the month of maturity. For example, one month from July 18 is August 18, and two months from July 18 is September 18. If a note is issued on the last day of a month and the month of maturity has fewer days than the month of issuance, the note matures on the last day of the month of maturity. Note that in this calculation we expressed the time period as a fraction of a 360-day year because the interest rate is an annual rate and the note life was days. For example, the maker owes $200,000 to the payee at a 10% interest rate, and pays no interest during the first year. The note has now been completely paid off, and ABC has recorded a total of $246 in interest income over a three-month period.

Notes receivable is, therefore, an asset of a company, organization, or bank that holds a written promissory note from another party. A business should classify a note receivable in the balance sheet as a current asset if it is due within 12 months. However, if the note receivable is due more than 12 months, it should be classified as a non-current (long-term) asset. Examples of notes receivable include employee cash advances with a written promise to pay and uncollected trade accounts receivable (sales owed to a company on credit) converted into promissory notes. As you’ve learned, accounts receivable is typically a more informal arrangement between a company and customer that is resolved within a year and does not include interest payments. In contrast, notes receivable (an asset) is a more formal legal contract between the buyer and the company, which requires a specific payment amount at a predetermined future date.

Using Notes Receivable to Generate Cash

Let’s say that our example company turned over the $2,200 accounts receivable to a collection agency on March 5, 2019 and received only $500 for its value. For example, if a business wants to borrow $7,000, Square might charge a total of $7,910 for the loan. Upon approval, the $7,000 is deposited into the business’s checking account the next day and then Square charges 9% of the business’s credit card sales each day until the $7,910 is fully paid. Square says that the advantage of this percentage-of-sales method is that the business does not have to make large payments when business is slow. The percentage that Square charges stays constant until the loan is paid off fully. Sometimes a company receives a note when it sells high-priced merchandise; more often, a note results from the conversion of an overdue account receivable.

- A company that frequently exchanges goods or services for notes would probably include a debit column for notes receivable in the sales journal so that such transactions would not need to be recorded in the general journal.

- When the maker of a promissory note fails to pay, the note is said to be dishonored.

- However, companies must use the accrual method of accounting and follow some specific rules when recording notes receivable.

- The accounting treatment will be the same for IFRS and ASPE since both sets of con- ditions (risks and rewards and control) have been met.

- Even though the interest rate is not stated, the implied interest rate can be derived because the cash values lent and received are both known.

Such expenses are non-cash in nature and have to be reflected in the cash flow statement by reducing it from the net income. Bad debts that are written off against dishonored notes impact the dividend distribution that is meant for the shareholders as well as retained earnings. Anne’s Apparel sells some items of clothing to Jenny’s Online Store for $15,000, with payment due in 30 days.

Balance Sheet Reporting and Disclosures: Assets-Accounts Receivable

Also, if customers are known to default on paying their accounts, the seller may insist that they sign a note for the balance. The $33 of interest revenue is the one-month portion of the interest that the company earns in this period while the other 5 months of interest have already been earned in the prior period. The amount due at the end of 6 months including the principal of $5,000 and the interest of $200 (5,000 x 8% x 6/12 ). Hence, the amount due at the end of the note maturity is $5,200 (5,000 + 200).

For scenario 3, there is an immediate reduction of principal due to the first payment of $1,000 upon issuance of the note. The remaining four payments are made at the beginning instead of at the end of each year. This results in a reduction in the principal amount owing upon which the interest is calculated.

Financial Accounting

The amount of credit sales (or total sales, if credit sales are not determinable) is multiplied by the percentage that management estimates is uncollectible. Factors to consider when determining the percentage amount to use will be trends resulting from amounts of uncollectible accounts in proportion to credit sales experienced in the past. The resulting amount is credited to the AFDA account and debited to bad debt expense.

It is possible to combine the previous two entries by debiting Notes Receivable and crediting Sales. Together, the principal and interest portions represent the note’s maturity value. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Intermediate Financial Accounting 1 by Michael Van Roestel is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. Notes receivable are initially recognized at the fair value on the date that the note is legally executed (usually upon signing). In the event, though the amount may have been written off, the customer is bound to settle the amount.

Dishonored Notes Receivable Definition

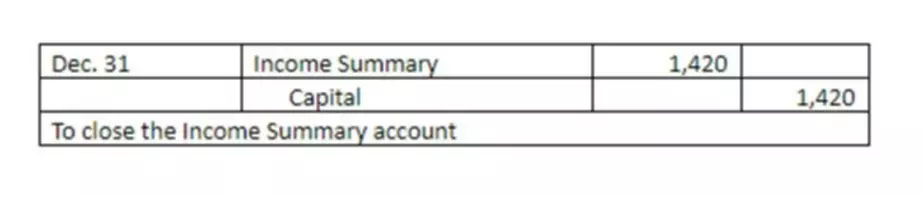

Subsequently, if the accounts receivable prove uncollectible, the amount should be written off against the Allowances account. The Fenton Company should also indicate the default on the Zoe Company’s subsidiary accounts receivable ledger. Furthermore, by transferring the note to Accounts Receivable, the remaining balance in the notes receivable general ledger contains only the amounts of notes that have not yet matured. When the payment on a note is received, Cash is debited, Note Receivables is credited, and Interest Revenue is credited. In any event, the Notes Receivable account is at the face, or principal, of the note. No interest income is recorded at the date of the issue because no interest has yet been earned.

The company records the proceeds of the loan received from the finance company as a liability with the loan interest and any other finance charges recorded as expenses. If a company defaults on its loan, the finance company can seize the secured receivables and directly collect the cash notes receivable from the receivables as payment against the defaulted loan. Some companies will issue zero-interest-bearing notes as a sales incentive. Even though the interest rate is not stated, the implied interest rate can be derived because the cash values lent and received are both known.

Present Value – Accounting Examples (for

Is because the amortization of the discount is in equal amounts and does not take into consideration what the carrying amount of the note was at any given period of time. At the end of year 3, the notes receivable balance is $10,000 for both methods, so the same entry is recorded for the receipt of the cash. Note that the interest component decreases for each of the scenarios even though the total cash repaid is $5,000 in each case. In scenario 1, the principal is not reduced until maturity and interest would accrue over the full five years of the note. For scenario 2, the principal is being reduced on an annual basis, but the payment is not made until the end of each year.

If receivables are sold with recourse, the seller guarantees payment to the purchaser of the receivables, if the customer fails to pay. For sales without recourse, all the risks and rewards (IFRS) as well as the control (ASPE) have been transferred to the factor, and the selling company no longer has any involvement. This makes intuitive sense since the stated rate of 10% is equal to the market rate of 10%. The AFDA ending balance after the adjusting entry would correctly be $8,000 ($300 debit + $8,300 credit).

After 60 days of nonpayment, the two parties agree that Jenny will issue a promissory note to Anne for $15,000, at an interest rate of 10%, with a payment of $5,000 due at the end of each month for the next three months. They play a part in increasing collectability of amounts owed, plus they generate revenue in the form of interest. Accounting for notes receivable can be burdensome and error-prone if approached manually. Knowing that you can collect interest revenue on your notes receivable is only half the battle; knowing how to properly calculate and record earnings is needed, if you are to keep proper financials. Having a clear and accurate picture of your business’ financial status will be helpful if you choose to pursue outside financing or need to make important business decisions in the future. Square, the mobile payments company, allows small businesses to take credit cards by swiping customer credit cards using a small square device attached to the audio jack found on mobile devices.

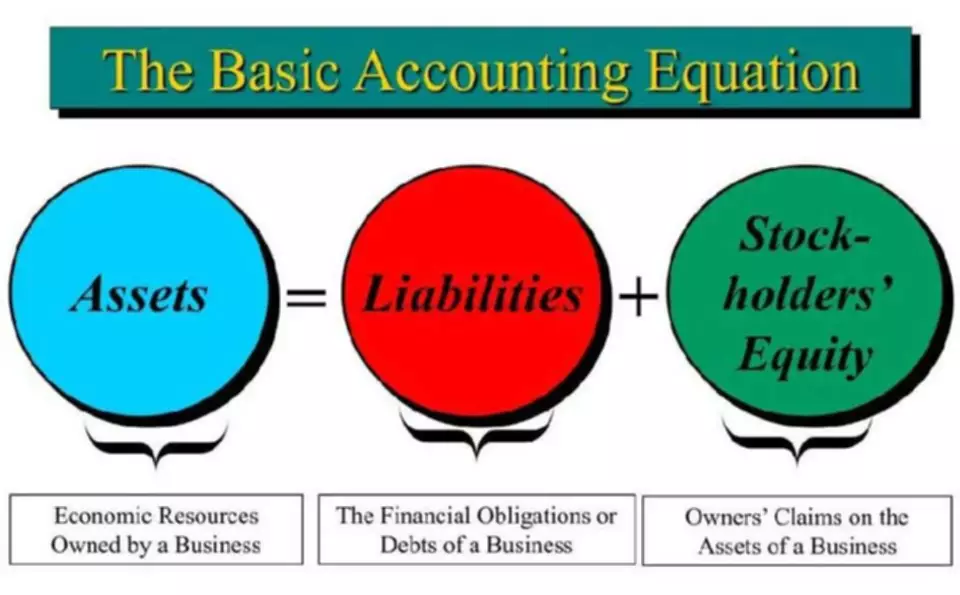

Why is notes receivable debit?

Notes receivable are recorded as a debit and not a credit. Notes receivable is an asset and as such would be recorded as a debit and not a credit. Assets, expense, and dividends accounts are all debit entries. Hence, they increase by a debit entry and decrease by a credit entry.

The amortized discount is added to the note’s carrying value each year, thereby increasing its carrying amount until it reaches its maturity value of $10,000. As a result, the carrying amount at the end of each period is always equal to the present value of the note’s remaining cash flows discounted at the 12% market rate. This is consistent with the accounting standards for the subsequent measurement of long-term notes receivable at amortized cost. It is common knowledge that money deposited in a savings account will earn interest, or money borrowed from a bank will accrue interest payable to the bank. The present value of a note receivable is therefore the amount that you would need to deposit today, at a given rate of interest, which will result in a specified future amount at maturity.

Accounting Tips for Construction Companies

Assuming D. Brown dishonors the note but payment is expected, the company records the event by debiting accounts receivable from D. Brown for $2,625, crediting notes receivable for $2,500, and crediting interest revenue for $125. Because the AFDA is a contra account to accounts receivable, and both have been reduced by identical amounts, there is no effect on the net accounts receivable (NRV) on the balance sheet. This treatment and entry makes sense because the estimate for uncollectible accounts adjusting entry (with a debit to bad debt expense) had already been done using one of the allowance methods discussed earlier. The purpose of the write-off entry is to simply remove the account from the accounting records.

- If Butchko anticipated difficulty collecting the receivable, appropriate allowances would be established in a fashion similar to those illustrated earlier in the chapter.

- Interest is accrued daily, and this accumulation must be recorded periodically (each month for example).

- Many companies set their credit policies to allow for a certain percentage of uncollectible accounts.

- This method also illustrates proper matching of expenses with revenues earned over that reporting period.

- Note receivable is honored when the payer makes the full payment including both principal and interest at the maturity date.

- The percentage that Square charges stays constant until the loan is paid off fully.